Market Early Warning Model

Current Score

--%

--

Trend History

Scroll to Pan | Pinch/Ctrl+Scroll to Zoom

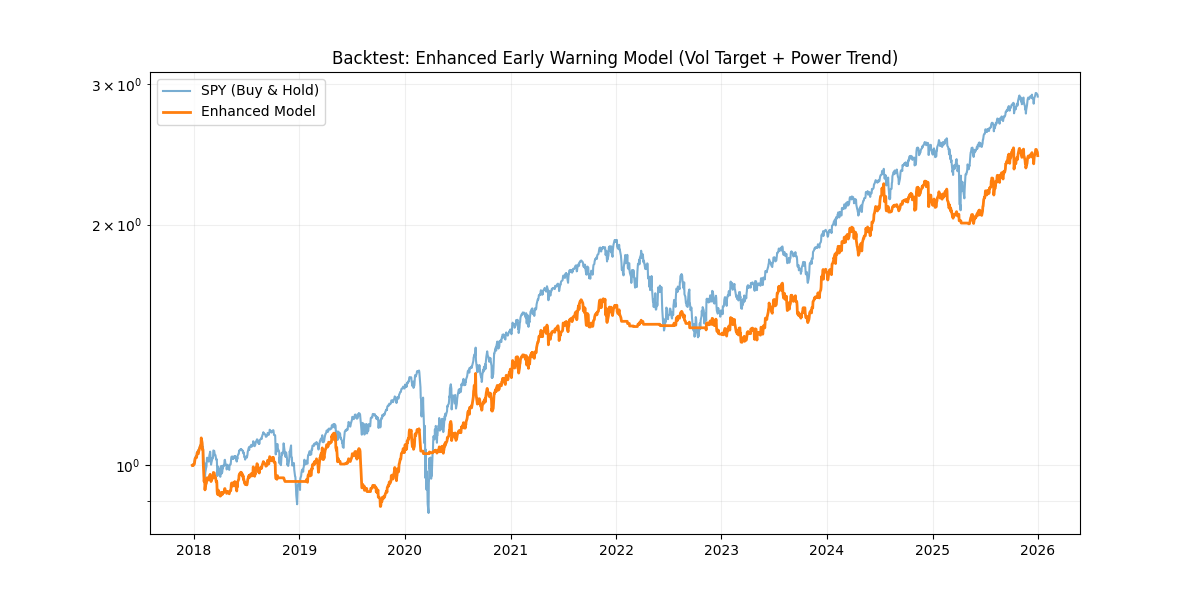

Historical Performance (10-Year Backtest)

| Metric | SPY (Buy & Hold) | Early Warning Model |

|---|---|---|

| Annual Return (CAGR) | 14.57% | 12.96% |

| Volatility (Risk) | 19.43% | 13.73% |

| Sharpe Ratio | 0.75 | 0.94 |

| Max Drawdown | -33.72% | -19.06% |

*Strategy uses Volatility Targeting (Target 15% Vol). Allocations are scaled based on Score:

• Score >= 60: 100% of Target Leverage

• Score 40-60: 50% of Target Leverage

• Score < 40: Cash

Composite Breakdown (Continuous)

Power Trend Rule Active: If Price > 50d SMA and Semis > 20w SMA, Minimum Score is floored at 60% (Invested).

| Metric | Weight | Strength (Z-Score) | Contribution | Values |

|---|

Strategic Allocation Rules

- 80-100% (Max Aggression): Leveraged ETFs, Tech, Growth.

- 60-80% (Standard Bull): SPY, QQQ.

- 40-60% (Caution): Low Volatility (USMV) or cash. Fuel or Engine broken.

- < 40% (Bear): Cash, Short, or Long Volatility.